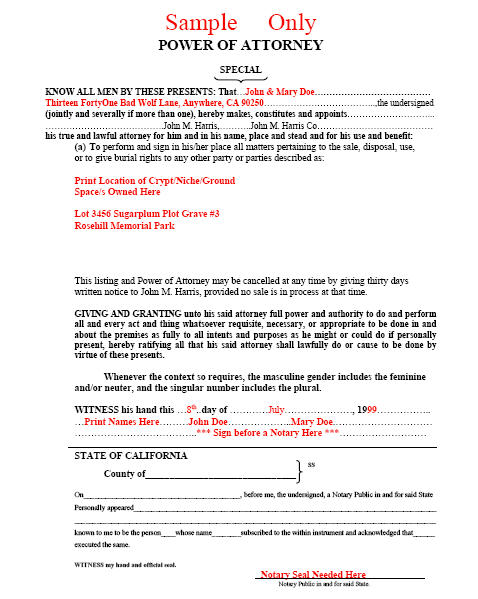

Lenders will request a signed Authorization Form from the seller before communicating with you. You are much better off using a Limited Power Of Attorney(POA) instead!

With a Power Of Attorney the lender must negotiate with you in good faith for a workout or mortgage modification. With an Authorization form, the lender only has to release information.

The difference is important because if you are having difficulty getting through to a lender simply ask the following question to a loss mitigator:

“I hold a power of attorney for Mr. Smith. Am I to understand that you are refusing to negotiate with me in good faith for a workout, mortgage modification or shorts sale?”

All of their calls are recorded and they will hate this question because they know many loans have guidelines that require then to negotiate in good faith. Now you have their attention.

Tip: An Authorization To Release Information can be used but a Power Of Attorney is superior.

Please send me the IndyMac Short Sale Package & as a bonu